Dubsado’s New Payment Features: A Complete Guide to Klarna and Affirm Integration

Looking to offer flexible payment options to your clients without the risk? Here’s everything you need to know about Dubsado’s latest payment integrations and how they can benefit your creative business.

Understanding Buy Now, Pay Later in Dubsado

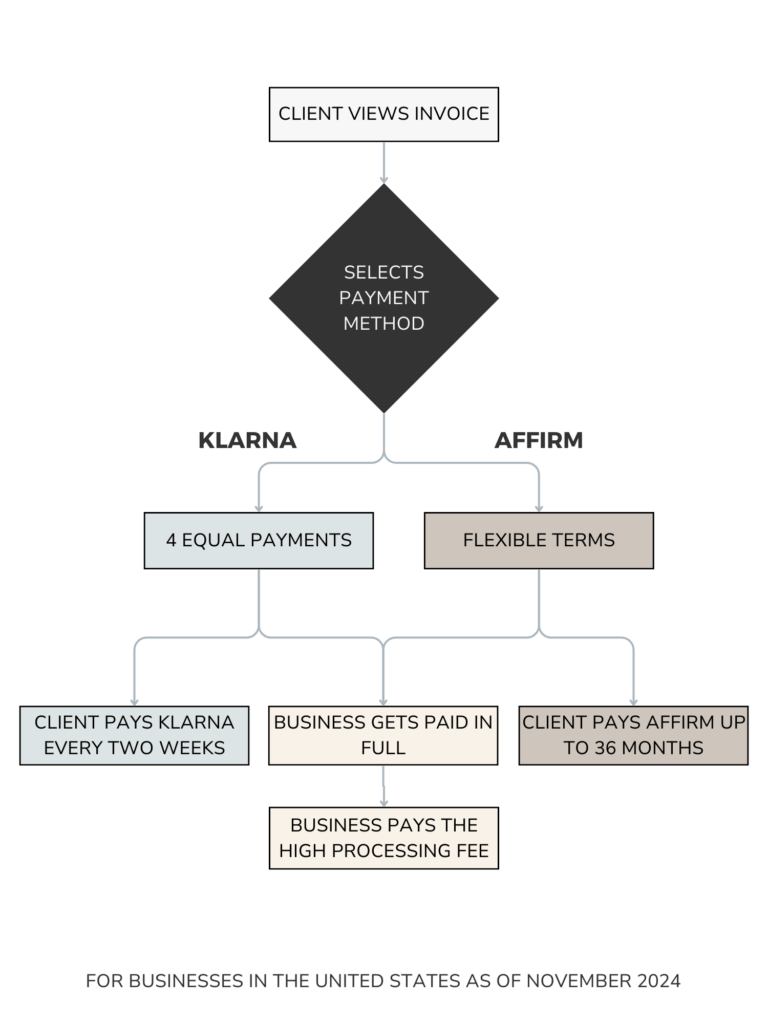

Dubsado has introduced two powerful payment options backed by Stripe that revolutionize how creative entrepreneurs can handle client payments. These new features – Klarna and Affirm – allow business owners to receive full payment upfront while offering clients flexible payment plans. This significant update addresses a common pain point for service-based businesses: balancing immediate cash flow needs with client payment flexibility.

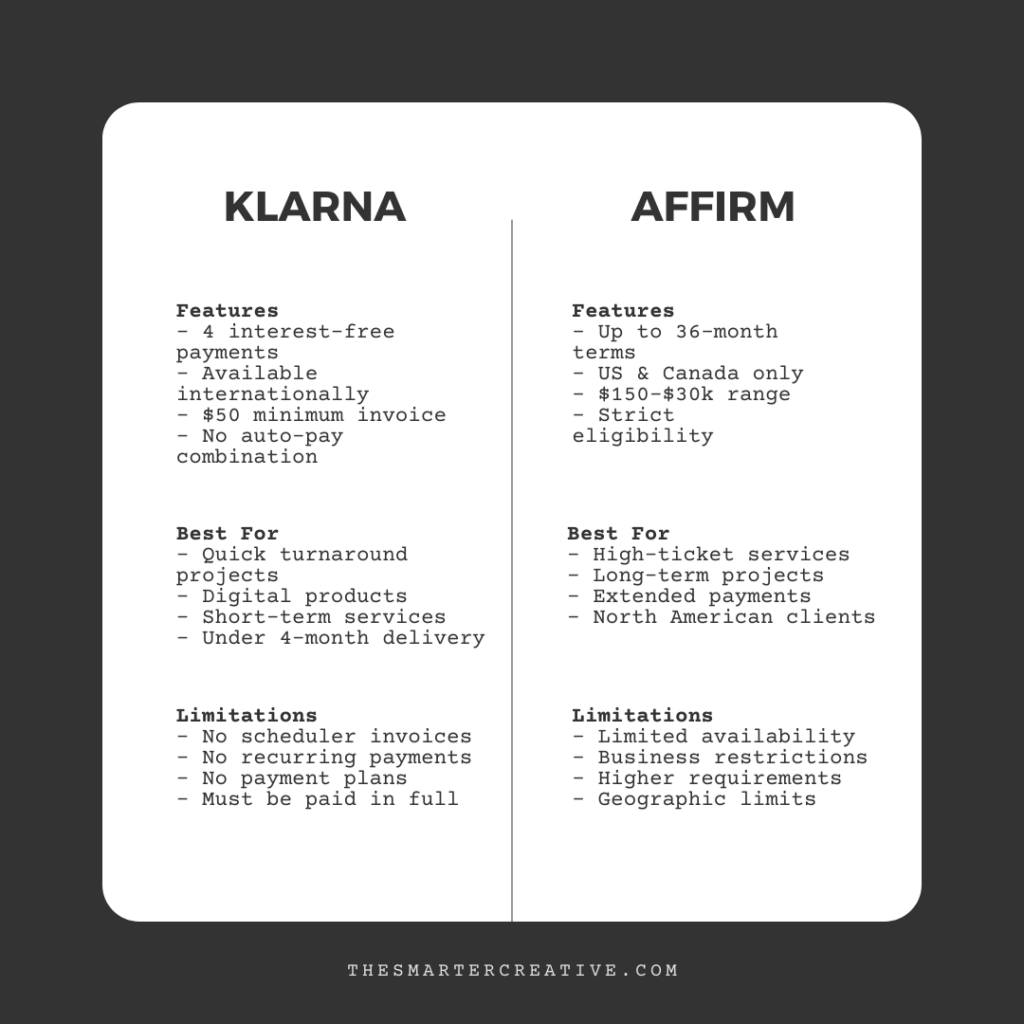

Klarna: The Universal Option

Key Features

- Available in multiple countries

- Offers four interest-free payments to buyers

- Requires minimum invoice amount of $50

- Processing fee approximately 6% plus $0.30 per transaction

- Cannot be combined with auto-pay or scheduler invoices

Best Use Cases

Klarna shines for short-term projects with quick turnaround times. It’s particularly valuable for:

- Course creators selling digital products

- Design projects with brief timelines

- Quick-turnaround services

- Products or services delivered within four months

Limitations

While Klarna boasts wide availability, it comes with certain restrictions. The service cannot be used with:

- Scheduler invoices (like mini sessions)

- Recurring payments

- Auto-pay enabled invoices

- Payment plans already in place

Affirm: The Extended Payment Solution

Key Features

- Available in US and Canada only

- Offers multiple payment terms up to 36 months

- Handles invoices from $150 to $30,000

- Similar processing fees to Klarna (approximately 6% plus transaction fee)

- More strict business eligibility requirements

Payment Structure

Affirm offers multiple payment options:

- Four interest-free payments every two weeks (for purchases up to $250)

- Extended financing options up to 36 months (for invoices $150-$30,000)

Business Eligibility

Not all businesses qualify for Affirm integration. Eligibility depends on:

- Business classification in Stripe

- Geographic location

- Type of services offered

- Business history and standing

Making the Right Choice for Your Business

Consider Your Business Model

Before enabling either payment option, evaluate:

- Typical project timeline

- Average invoice amount

- Current payment plan offerings

- Client payment preferences

- Profit margins (to account for processing fees)

When to Use Klarna

Klarna works best for businesses that:

- Need immediate payment for quick-turnaround projects

- Offer products or services under $1,000

- Want to provide short-term payment flexibility

- Have international clients

When to Use Affirm

Affirm is ideal for businesses that:

- Offer high-ticket services

- Have longer-term engagements

- Want to provide extended payment options

- Are in the United States or Canada and eligible to use the service

Implementation Tips

Pricing Strategy

With processing fees around 6%, businesses should:

- Factor fees into pricing structure

- Consider the value of immediate payment

- Evaluate the potential for increased bookings

- Monitor the impact on cash flow

Client Communication

When implementing these payment options:

- Clearly communicate payment terms

- Highlight the benefit of interest-free payments

- Explain eligibility requirements

- Set clear expectations about delivery timelines

Making the Decision

While these payment options can boost bookings and improve cash flow, they’re not right for every business. Consider your specific needs:

- If you already offer payment plans that span your service delivery period, Klarna might not add significant value

- For high-ticket services with extended delivery times, Affirm could provide a competitive advantage

- Businesses with tight margins should carefully evaluate the impact of processing fees

Remember, you can toggle these options on and off as needed, allowing you to test their impact on your business without long-term commitment. The key is understanding your clients’ needs and your business requirements to make an informed decision about implementing these payment features.